Robin Derryberry

Gaining the advantage in a sellers’ market starts with a healthy credit score.

Chattanooga is experiencing a building boom. From new projects on the Southside to condos in the urban core of our downtown, there’s a diverse selection of housing options.

For some in our community, the opportunities of home ownership, renting an apartment or getting a car loan are out of reach due to low credit scores. And Chattanooga isn’t alone. According to The Motley Fool, 43 percent of credit scores are below 700 in the U.S.

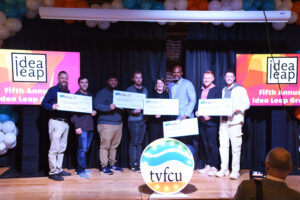

Several years ago, First Tennessee saw a need to assist in restoring financial dignity to people hit hardest during the recession, as well as those struggling to make ends meet. They opened the city’s first Hope Inside program in their Eastgate Financial Center. As part of Operation Hope, the program is designed to improve credit scores through budgeting techniques for getting the most out of a limited income. In addition, the program offers instruction on paying off debt and using credit smartly. Thanks to the success of the first program, the bank opened a second at its East 23rd Street financial center last year.

First Tennessee joined Chattanooga Neighborhood Enterprise and other nonprofit partners across the city during a recent day-long workshop focusing on credit scores for Chattanoogans. The event provided resources and information to encourage the development of personal budgets and other efforts toward financial stability. The hashtag #CHA720 was the moniker for the day and encouraged individuals to take the pledge of 720 as a goal credit score, but also encouraged a longer-range view for financial stability.

“In order to be considered for credit cards, car loans and mortgages, the magic number for a credit score is 700,” says Jeff Jackson, First Tennessee market leader. “Lenders aren’t looking for perfect credit; however, they look to see the debt to income ratio and how an individual uses credit. Having a program to assist those who’ve had a difficult financial path is a perfect fit for First Tennessee and we’re very proud of those who’ve worked with our counselors.”

Jackson adds that participants do not have to be customers of the bank.

“Of course, we hope they’ll consider us as their banking partners, but the most important thing is to know that we’ve helped someone become financially stable. When they are successful, they become active contributing members to our local economy. It’s just good business.”

Push For Better Credit

Jackson recommends an annual credit check for everyone, unless you're planning to make a large purchase such as a car or home. In that case, it’s smart to know your score before you begin the purchasing process. Similarly, if you're rebuilding credit, it’s wise to consider a monthly progress check. Many sites offer free credit checks and the frequency of checking your credit does not impact your overall score.

As you take steps to make important purchases, it’s important to know how much buying power you have. Being pre-qualified for a home loan makes the process much easier, and starting with a credit score of over 700 is a strong foundation for you and your family’s future.

Chattanooga’s building boom is calling. Don’t be left behind due to a low credit score. There are resources available that will provide information and encouragement from financial professionals. Operation HOPE is one such option.

Together, we’ll have a stronger, more diverse community ready for whatever the future holds.