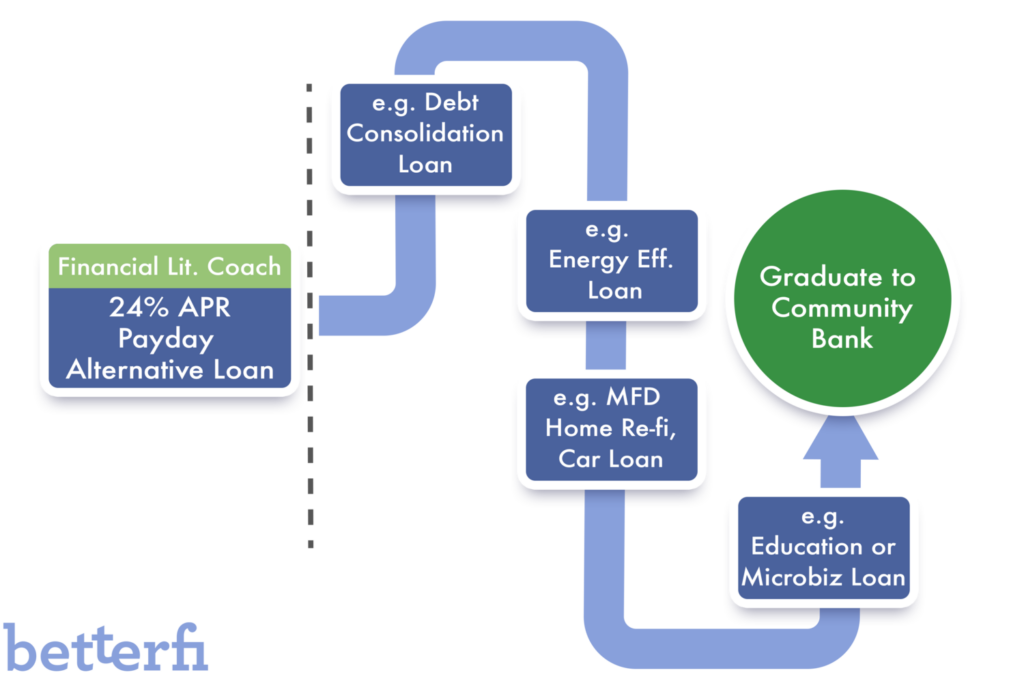

BetterFi, a nonprofit lender that aims to become the fairer alternative to payday, title, and flex loan financiers, recently joined the Chattanooga Chamber. This startup is looking to reach clientele who are enduring oppressive fees and interest by having entered into predatory loan agreements, and help them refinance at a much lower, fixed rate. To support their clients’ pathway out of debt traps, BetterFi offers financial coaching and other programs (such as assistance with income-tax prep) alongside its installment loans.

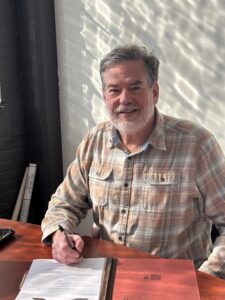

Spike Hosch established BetterFi in 2017 as an economic justice enterprise, now certified as a Community Development Financial Institution (CDFI). TREND sat down with Spike to learn more about BetterFi and his decision to join the Chattanooga Chamber.

TREND: Tell us about the origins of BetterFi. Why was this niche in the banking/finance sector interesting to you?

Hosch: I’d been working abroad in green energy finance and microfinance. There, the loan sharks we were competing with actually charged less than the American payday lenders. When I came back to the U.S., I got assigned to the Cumberland Plateau area as an AmericaCorps VISTA, and the project goal there was to create some entity focused on economic justice. After about a year of talking to people, it was clear an alternative to payday loans was a big missing piece. There were groups already attempting to address this need on a very small scale; churches were making emergency loans to parishioners and trying to get paid back. It made sense to offer a better solution than the pastor having to go around knocking on doors to get someone to repay the church a zero-percent loan.

2018 was a pilot year where we did maybe ten loans, trying to learn what we needed to know to be successful. When the pandemic hit, we paused and pursued certification as a Community Development Financial Institution (CDFI), which means a majority of our clients will come from some type of underserved population. As a CDFI we get access to technical assistance, and capital and grants from the federal government for things like loan loss reserves. While we’re based out of Grundy County, our service area is technically all of Tennessee and we’re now reaching into Hamilton County.

TREND: Describe what you know about the reasons why someone typically signs up for a predatory loan.

Hosch: When someone goes into a payday lender, they can usually walk out with money in a couple hours. Our turnaround time for processing a loan application is about a day, which is pretty good but not ideal relative to theirs. Most of our clients initially borrowed from one of these lenders because some unexpected expense came up. Maybe they got sick and were out of work for two weeks so they’d been living right at their means. Then that unexpected expense, like a car repair, happens while they’re behind the eight ball and they just can’t cover it. Often when low-income people are moving, especially if they don’t have good credit, not only do they have to come up with a cash deposit for the landlord, but to initiate service with the utilities as well.

Once someone borrows on one of these loans, they’ll end up spending $100, $200, $300 a month just paying the interest and fees alone, over and over again. And then if they can’t come up with the money for each month following, they can end up getting their wages garnished or their car repossessed. Usually these lenders don’t actually want their clients to pay off these loans: They’d rather they be stuck in a place where they’re more or less making the payments, covering the interest and fees, indefinitely.

We’ve had some clients who took out title loans to start their small businesses. We helped them get out of that bad-debt trap and now they’re doing really well; one is even selling their product in Whole Foods stores throughout Tennessee. It’s insane to think they lost an entire year of momentum because they were spending every spare dollar to cover the exorbitant interest rate and fees on a loan they initially took out to purchase business supplies.

TREND: So by positioning BetterFi as a more just and humane alternative to payday, title, and flex lenders, are those companies your main competitors?

Hosch: Yes. There are some other consumer-focused CDFIs in the northeast and Florida, but they don’t help get people out of predatory loans. There really isn’t anyone refinancing people out of debt traps yet – in Tennessee, or among CDFIs. Some of the Chattanooga-based CDFIs are contemplating piloting some programs but there’s a near infinite demand for an alternative to payday loans. At any given time in Tennessee, there’s well over a billion dollars of debt in the form of payday, title or flex loans; for the U.S., it’s probably north of $40 billion.

TREND: If you’re assuming responsibility for higher-risk loan debt and competing directly with payday lenders, how do you stay in the black?

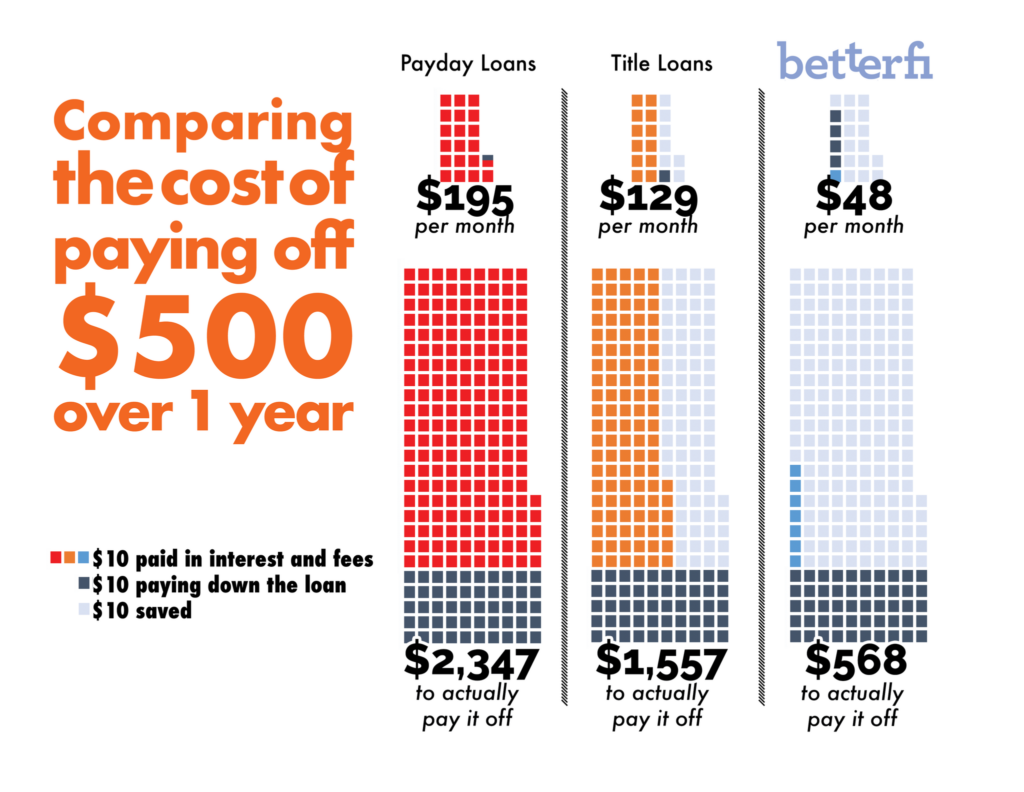

Hosch: We do charge simple interest on our refinance agreements at 24% per year – as compared to a payday loan at 460% interest. For instance, if someone borrows $500 in payday loans, next month they’ll owe $691. If I don’t come into that $691 next month, then that’ll result in another $191 tacked on for every subsequent month that I renew on the loan. We’ve seen people who maybe pay $100 a month for a year on an initial $500 payday loan; that’s well over $1,000 to get out of it (double or more). If that same $500 is amortized over the course of a year, BetterFi would pull in about $64 in interest – not necessarily “cheap,” but orders of magnitude better.

Our earned revenue from interest, however, does not cover our basic costs. For that, we rely on additional support through donations from individuals and foundations. Our CDFI status also means traditional banks can give us money to help them meet federal requirements for serving vulnerable populations. We plan to work with banks to access capital for our loans while relying on philanthropy to cover operating costs, and then over time build the volume of accounts needed to cover more of our operations through revenue earned from interest.

TREND: Did BetterFi have any early investors to help start the company?

Hosch: To get off the ground, foundations in the Sewanee and Chattanooga areas gave us some seed grants, and folks in Grundy County really stepped up to help with the launch. Joining the Chamber is a part of helping us grow because at this point we don’t do a lot of consumer advertising. Most of our clients come from referrals, via churches or other nonprofits. Through the chamber circuit we hope to connect with employers and other businesses that can use us as a resource for their employees.

BetterFi should be of interest to employers because a huge percentage of their payroll could be going toward employees’ debts with predatory lenders. That’s money that’s not being spent at local restaurants and shops, to cover things like car repairs, or to invest in children and families. We can actually go in and buy out that bad debt with whichever lender and refinance it. So the client usually pays less than half, per month and in total, than they otherwise would’ve paid in interest and fees with the original lender, and then typically they’re out of that debt completely within a year.

—

According to Prosperity Now, in 2018 out of approximately 145,000 households in Hamilton County:

- 25 percent lacked sufficient net worth to subsist at the poverty level for three months in the absence of any income, and 17 percent had zero net worth;

- 32 percent lacked sufficient liquid assets to subsist at the poverty level for three months in the absence of any income;

- About 6 percent were unbanked, meaning no bank account whatsoever is used in the household; and 16.5 percent were underbanked, which can mean relying on a payday loan or rent-to-own agreement to meet their needs.